There’s a psychological trap buried in every interest rate cut — and it catches even the most diligent borrowers. The trap? The assumption that lower rates should equal lower repayments. On paper, that makes perfect sense. But if you’re serious about building wealth, minimising interest, and obliterating your mortgage timeline, this is the precise moment you double down.

The following article focuses on the continuation of your current payment when rates drop. We understand that this is a privilege, and one that many cannot afford, so please understand that the strategy applies to those that are in a position to afford it right now. If you’re encountering any measure of financial distress, you should first call us, but you should certainly plan on implementing the strategy when your circumstances improve. Remember, the benefit of extra repayments is that the funds are always available in an offset.

Offsets are Extra Repayments: If all your available funds are paid into an offset account, then the concept of ‘extra repayments’ is a little moot since your ‘available funds’ balance will not change… so the increasing funds in your offset will simply apply more downward pressure on your loan term. Don’t worry – we’ll discuss these concepts with you so you have a full and complete understanding.

Let’s unpack it with precision — and a little strategy.

Same Repayments, Lower Interest

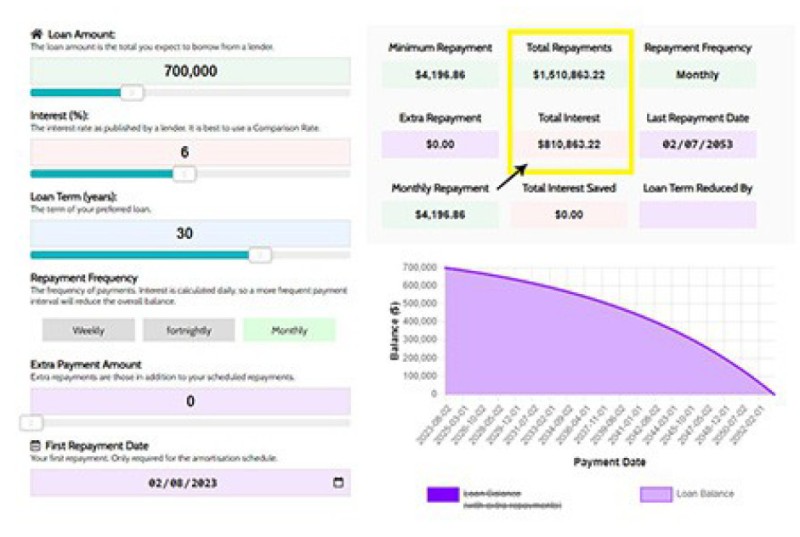

Take a $700,000 mortgage over 30 years. At an interest rate of 6%, your minimum monthly repayment is $4,196.86.

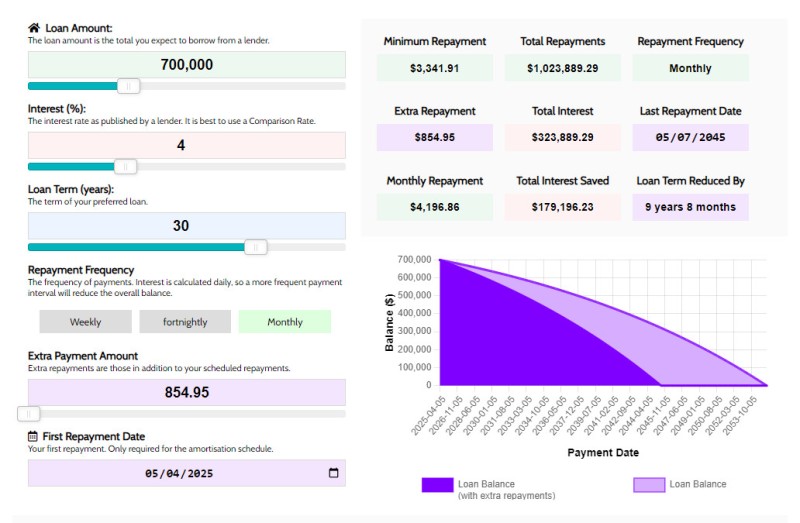

Pictured: Screenshots from our ‘Advanced Website Calculator’. It’s small, so you might want to check out our website yourself. What the calculator shows is that on a $700,000 mortgage over 30 years at 6%. Note that while we’ve shown monthly repayments, fortnightly repayments will save you thousands in Interest over the life of your loan.

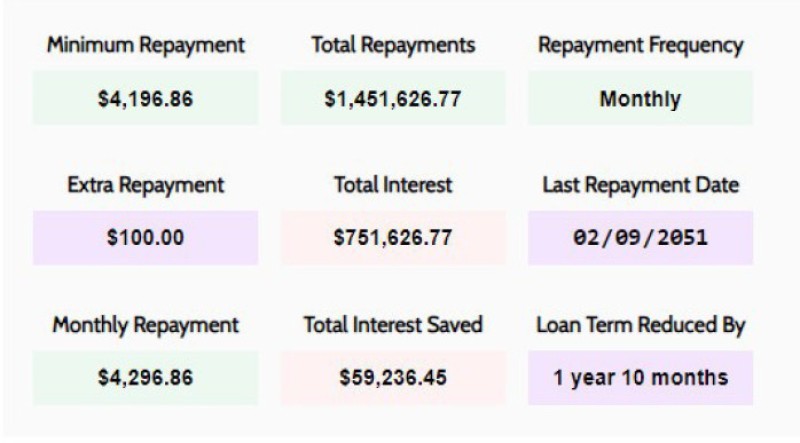

Let’s look at the impact of paying an extra $100 per month.

Pictured: Without a change in rate, but by simply paying an extra $100 into our mortgage, we have reduced the term already by 1 year and 10 months, so nearly 2 years… and it was just $100 on top of a $4197 obligation.

Without a change in rate, but by simply paying an extra $100 into our mortgage, we have reduced the term already by 1 year and 10 months, so nearly 2 years… and it was just $100 on top of our $4197 obligation.

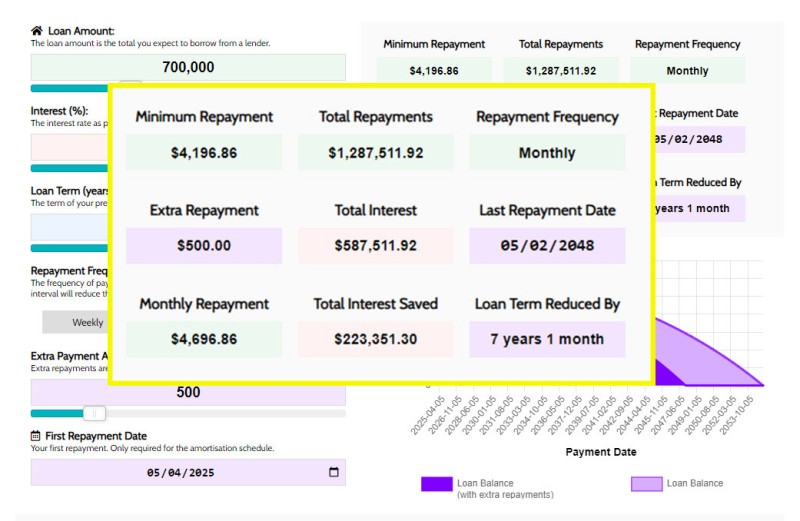

$500 Extra Every Month

Now let’s push this a little further and add $500 per month on top of our $700k mortgage obligation (at 6%). The result? You’ll cut your loan term by over 7 years faster. That’s not a lottery win; it’s a single lifestyle trim, consistently applied.

Pictured: We’ll add $500 per month on top of our $700k mortgage (at 6%). The result? You’ll cut your loan term by over 7 years. That’s not a lottery win; it’s a single lifestyle trim, consistently applied.

Let me rephrase: by repurposing $500 that might otherwise drift into lifestyle creep, you’re accelerating toward financial sovereignty. And you’re doing it without exotic financial products or risky market speculation — you’re doing it with discipline.

If you’re leveraging investment property income, rental yield, or salary bonuses into your repayment strategy, this effect is magnified even further.

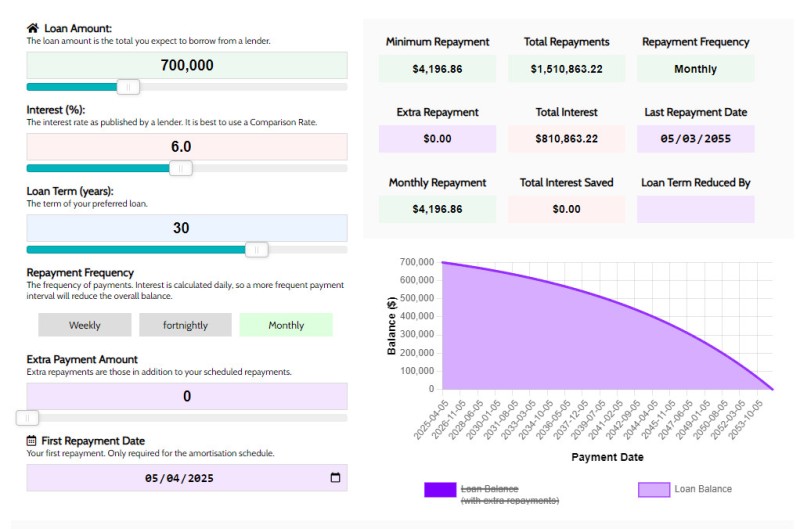

An Example of a Rate Drop

Consider the following $700,000 mortgage over 30 years. We’ll look at a rate of 6% (as we used above) and another at 4% – a crazy drop, but not unreasonable over time. Repayments are paid monthly for illustration purposes only.

Pictured: A $700,000 mortgage over 30 years at 6%. Repayments are paid monthly for illustration purposes only. The minimum monthly obligation in this case is just under $4197.

If the interest rates drop to 4.0% (again, unreasonable, but let’s go with it) — your new minimum repayment would fall to $3,341.91. That’s a drop of $854.95 per month (measured against the former 6% obligation). The average borrower sees that difference and thinks: holiday money. Bali. Renovation budget. Breathing room. And to be fair, it can be all of those things.

But what if you kept your repayments at the original 6% level, requiring an additional payment of $854.95 to match our previous obligation? You’d repay your mortgage 9 years and 8 months faster – nearly a full decade, saving hundreds of thousands in interest ($486’973.93, to be exact) — simply by holding the line. Let that settle for a moment: no new income, no new job, no fancy investment strategy — just resisting the urge to lower your repayments. Remember, this is based on monthly repayments and no other debt-reduction strategies applied, and we’ve already reduced our term by nearly a full decade.

Pictured: But what if you kept your repayments at the original 6% level, requiring an additional payment of $854.95 to match our previous obligation? You’d repay your mortgage 9 years and 8 months faster – nearly a full decade, saving hundreds of thousands in interest ($486’973.93, to be exact).

We’ll now look at a rate drop (with no change in payments) and extra repayments.

A Rate Drop and Extra Repayments

At this point, what we’ve done it match our initial monthly obligation, or the initial obligation when we accepted the mortgage, so while we’re paying extra, we’re not paying more than the mortgage initially required. Let’s take this one step further and look at a rate drop to 4% and extra repayments of $500 per month. The difference is significant.

At this stage we’re paying at extra $854.95 to match our initial 4196.86 obligation, or the amount that ‘we’ (or, more specifically, the lender) determined we could service when the mortgage commenced. If we pay an extra $500 on top of our $854.95, so increase our monthly repayment to $1354.95, we slash our repayments by 12 years and 9 months, and save hundreds of thousands in interest.

Pictured: If we pay an extra $500 on top of our $854.95, so increase our monthly repayment to $1354.95, we slash our repayments by 12 years and 9 months, and save hundreds of thousands in interest.

Factor in fortnightly repayments and the difference is seriously significant.

The lesson: match repayments and pay extra where you’re able to pay extra.

The Psychology of Overpayment:

What’s at play here is not just arithmetic, but behavioural finance — a field that examines how emotion and habit shape our decisions. Left unchecked, we adapt our spending to match the room we’re given. Lower repayments are often met not with savings discipline, but with lifestyle inflation.

The key to mortgage dominance isn’t a higher salary. It’s tactical restraint.

Budgeting: Strategy, Not Sacrifice

Let’s dispel a myth: aggressively repaying your mortgage doesn’t mean a life of instant coffee and no joy. But it does require clarity.

Take Simon — a perfectly average Aussie borrower. He tracked a week of expenses, categorised them into essential, useful, and wasteful, and discovered he could redirect $60 per week ($240/month) to his mortgage simply by cutting a lunch out, skipping a few beers, and making coffee at home three days a week.

Pictured: Simon is a perfectly average Aussie borrower. He tracked a week of expenses, categorised them into essential, useful, and wasteful, and discovered he could redirect $60 per week ($240/month) to his mortgage simply by cutting a lunch out, skipping a few beers, and making coffee at home three days a week.

These are not life-altering sacrifices. They’re conscious allocations.

$800,000 Loan at 5% Over 30 Years

Let’s turn to another scenario.

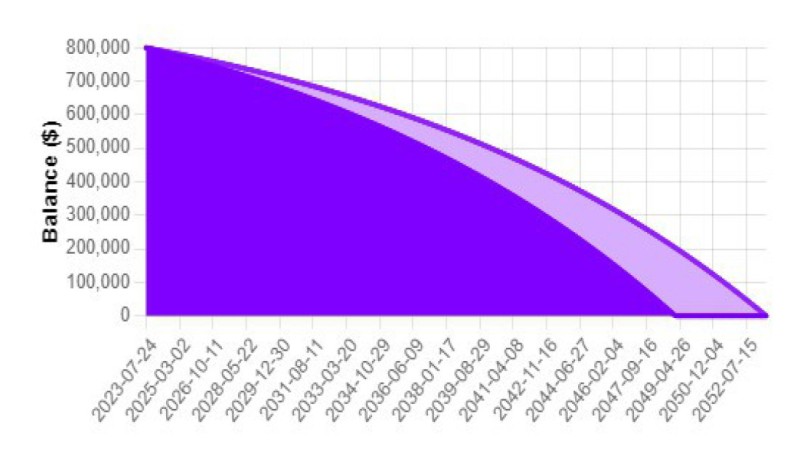

A borrower with an $800,000 loan at 5% over 30 years. We’ve modelled the impact of modest additional repayments using our in-house calculator (available on our website for your own testing).

- $120/month extra (the cost of one cheap takeaway coffee per day) cuts 4.5 years off the loan term.

- $300/month extra cuts 7.5 years.

These are not hypothetical figures. They are the real, compounding outcomes of minor behavioural changes — changes available to almost every borrower, irrespective of income bracket.

The Real Cost of a Cup of Coffee: We look at the real cost of a daily cup of coffee in an article titled “What is the Real Impact of a Daily Cup of Coffee on Your Mortgage?” Replace coffee with avocado toasties or any other of those daily indulgences.

Play Chess, Not Checkers

Most borrowers are playing checkers. They see a rate drop, they move a piece. Lower repayments, happy days.

But the strategic borrower is playing chess. Every move is premeditated. They’re thinking about five moves ahead — the endgame of financial freedom.

And that endgame isn’t about maximising leverage. It’s about deploying discipline, intelligence, and structure to win a war most people don’t even realise they’re fighting.

Don’t just refinance. Don’t just drop your repayments. Refocus. Keep the pressure on. And watch how rapidly your mortgage buckles under the weight of your consistency.

Because the borrower who understands the power of overpayment doesn’t just save time and money — they win the entire game.