A Guarantor Loan, Family Pledge Loan, Limited Guarantee, or “Equity Guarantor” loan is one where the guarantor enables entry to the property market to a buyer by offering your own fully or partially-owned property as security. You are essentially co-borrowing without the financial commitment; should the borrower fail to meet their obligations you inherit the liability.

It is extremely important to understand your obligations if you choose to make your equity available to (usually) a family member for this kind of loan because it does restrict the freedoms you enjoy, such as the ability to easily refinance or sell your property.

You should refer to the FAQ that deals with the Guarantor Home Loan, and to fully understand the obligations of the borrower and the Guarantor.

First, who qualifies as an acceptable Guarantor? Most banks will consider the following groups of people (thus the name “Family Pledge”).

- Parental guarantees.

- Adult children

- Spouse (applicable in cases when asset protection strategies are in place).

- Defacto partners.

Consistent with the “Family Pledge” connection, the following groups are assessed on a bank-by-bank and case-by-case basis.

- Grandparents (although pensioners and other retirees are generally discouraged by banks from participation).

- Step-parents and legal guardians.

- Children or stepchildren.

- Step-siblings and siblings.

Other extended family members are generally considered unacceptable, such as cousins, Uncles, and Aunts. If not listed in the acceptable category it’s likely that they won’t qualify.

Guarantor Eligibility Requirements

The following eligibility requirements applies for a guarantor for most banks.

- Age. Must be 18 years of age.

- Australian Property. Your guarantor’s property must be in Australia.

- Equity. The guarantor needs to either own their property outright or owe less than 80% of the property value on their mortgage. Some lender policy varies, and their assessment of the Limited Guarantee will also vary from lender to lender.

- Siblings. And Step-siblings.

- Currently Working. The guarantor should be working. This limits the risk on behalf of the bank since they don’t like coming after an elderly retiree should the borrower’s conditions go South. Retirees are considered in some cases if they source good legal advice, and the demonstrate a sound mortgage exit strategy.

Other conditions may apply so we encourage you to contact us for a no-obligation discussion.

Limiting Liability with a Limited Guarantee

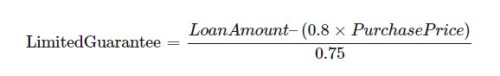

Where available, and when applicable, we tend to recommend a Limited Liability Guarantee because it uses a portion of the equity in your home, rather than your entire property. thus limiting your exposure. You may determine the limited guarantee with the following formulae:

Use the calculator below to determine the limited guarantee obligation. It’s a basic calculation only; it doesn’t include such factors as debt consolidation, security property type, your 5% genuine savings  , and whether it’s a construction loan. We’ll help you with the finer details.

, and whether it’s a construction loan. We’ll help you with the finer details.

The calculator provides the option to have your current mortgage assessed to determine if you’re able to provide the Pledge with your outstanding loan balance. The value of the Pledge and Limited Guarantee should not exceed 80%.

Related Articles in our Blog

You may find useful information and articles in our blog. Feel free to call anytime on 0280068300 for any reason.