Compound interest is the addition of interest to the principal sum of a loan – basically meaning that you pay interest on interest. Compound interest is standard practice when taking out a home loan. The purpose of this page is to introduce you to the measures you should take to minimise the interest over the term of your loan – you can literally save hundreds of thousands of dollars.

Interest on a home loan is generally calculated on a daily basis on the outstanding balance of the loan. How much interest you end up paying on your loan will depend on a range of factors, including the loan amount, interest rate, loan term, repayment frequency and whether you make any extra repayments or make use of an offset account, if your loan has this option.

Practically, an interest calculation ‘typically’ involves multiplying your loan balance by your interest rate and dividing this by 365 days (some lenders divide by 366 days during leap years). This is your daily interest charge. This is then usually multiplied by the number of days in the month to work out your monthly interest amount. So, compound interest is calculated daily meaning that the more funds you have paid off, or site in your offset account (every single day), the lesser interest is calculated. At the end of the month, your bank will add together the daily interest charges for each and every day of the month (including leap years), and this is the monthly interest amount you see on your statements.

Consider a home loan of $400’000 with an annual interest rate of 3.5% (yours might be higher or lower). $400’000 multiplied by 0.035, and then divided by 365 (the number of days interest is calculated) returns $38.36 in interest every single day.

The smaller the outstanding balance, or the lower the interest rate, the lower the daily interest you will pay, and the sooner you’ll start to pay off the principal outstanding amount. It’s worth perusing our blog for articles on debt reduction because paying off your home loan sooner essentially underpins our service.

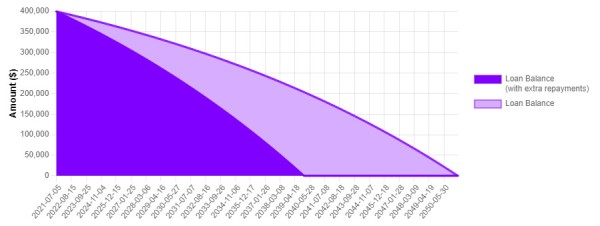

It’s worth taking to our loan calculators at this point to examine the effect of extra repayments. If we take the above $400,000 loan and pay an additional $300 per month we’ll reduce the repayment term by over 10 years (the area shaded in dark purple illustrates the shorter term).

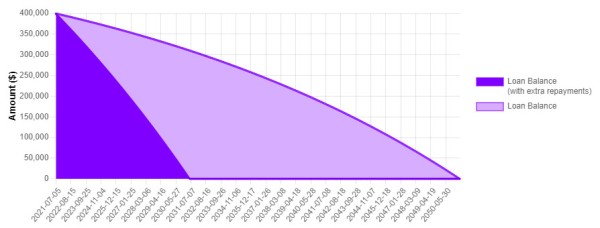

Let’s take this one step further and look at additional payments of $1000 per month.

As you can see, paying interest on a smaller daily balance by paying off your loan as quickly as possible makes a big difference. An offset account makes this an effortless task by counting your savings against your home loan balance (in the above example, if you had $100’000 in savings you would only pay interest on $300’000).

In the above cases we assumed the payment of funds on a monthly basis. If we pay fortnightly – remembering that interest is calculated daily – we’ll further reduce the balance. Additionally, paying fortnightly squeezes in an extra repayment every year.

There are a large number of factors that impact upon your interest repayments, and the topic tends to be one that we discuss over and over on our blog.